Bootstrapping DeFi Protocols with NFTs in the Metaverse

by Florian Glatz

Bootstrapping DeFi Protocols with NFTs in the Metaverse

Tl;dr: We present a new method to launch DeFi protocols that increases compliance of builders and gives operators of the protocol a fighting chance to legally exit the realm of TradFi regulation. The method allows developers of DeFi protocols to monetize their work, empower their community and stay fully compliant in the process. The method we present can be framed as “radical decentralization”, continuing — yet fundamentally changing — the previous approach popularized as “progressive decentralization” [1].

Our method consists of releasing the protocol IP to the public at large, coupled to an NFT sale that — while unlocking the IP — allows NFT buyers to bootstrap an on-chain community of users.

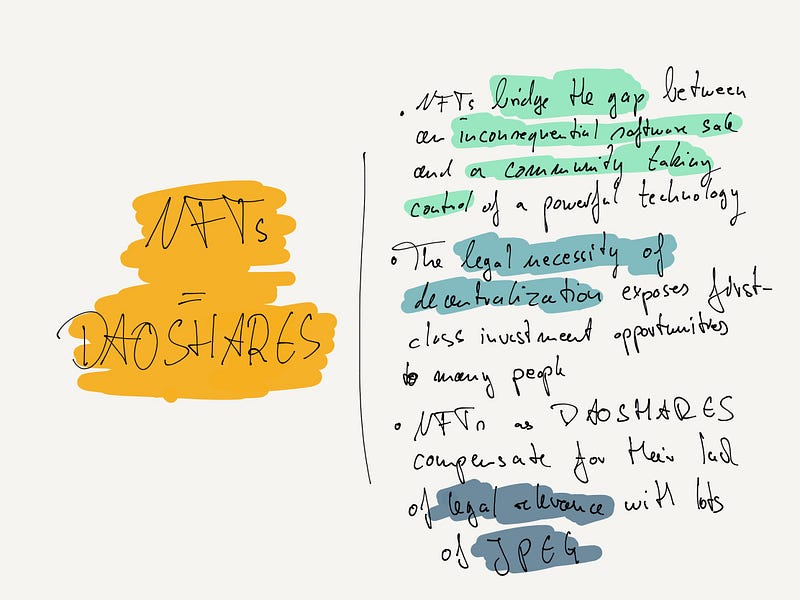

The method we presented is based on the following insights:

- The public release or sale of IP — unlike that of financial instrument-like crypto assets — carries no compliance risks for builders in terms of capital market regulation

- Tokenizing the IP rights as NFTs before selling them allows buyers to coordinate around what to do with the IP after the sale, independent of the seller

- Containerizing IP with NFTs can be done in various ways. We came up with a novel method that leans heavily on technology as opposed to contractual arrangements, while addressing all potential legal matters with a maximally permissive open source license for all IP being thusly transacted.

Looking at the history of funding mechanisms for builders using blockchain and crypto assets, this launch method is fundamentally different from the lineage of solutions that started under the moniker “App Coins” in the years 2014–2016, and which has since evolved into the current state of governance tokens. While both funding mechanisms employ crypto assets, our method uses those assets to document on-chain who contributed to the unlocking of the open source IP, leaving it up to the community of buyers to figure out how to exploit it.

Introduction

Decentralized Finance exists at the intersection of play and exchange. While the exchange part is fully automated and trustless, the play part is much more dynamic: it’s driven by communities, incentives, and conventions. It is where capital formation happens, and value is collectively created and distributed.

The Curve Wars are an interesting example of how play and exchange can come together.

Today, more than ever, DeFi is innovating at a pace that is too fast for regulators to absorb and deal with constructively, particularly when it comes to the governance of DeFi protocols. Decentralized governance of protocols by pseudonymous or anonymous stakeholders is not the way regulators imagined how financial infrastructure should be governed [2].

Progressive Decentralization: a collective chokepoint?

How are DeFi projects born? Typically, a set of founders build a team, raise venture capital, and start to build both code and a community. But how does a project go from that stage into a fully operational protocol, governed by a community of thousands of users and large capital reserves in a multisig?

According to some, including well-known investment firm a16z, the answer is progressive decentralization. The priority goes:

- Product/market fit

- Community participation

- Sufficient decentralization (community ownership).

While the commendable end goal is community ownership, the problem with this approach is the significant and — ultimately unbearable — legal exposure of builders for actions performed in the time between launch and eventual community ownership.

Today, builders often sell governance tokens to investors and the public while retaining some for themselves, to ensure they retain sufficient rights in the DAO governance scheme associated with the token they sold. While the sale of such a governance token is legally grey, compliance is achievable if the seller is willing to live with some uncertainties with regards to the future — possibly even retroactive — treatment of their token sale. The much more problematic points are the eventual deployment of the token issuer’s DeFi protocol on chain, its operation thereafter as well as the supply of frontends to facilitate access. The mere fact that the builders were involved in the deployment or continue to be involved in governance decisions carries an increased risk of regulatory scrutiny and potential criminal liability.

The problems arise when code makes a phase transition from mere text into embodied memory of a distributed state machine. As soon as the builders are involved in that process, they are subject to increased liability risk. Therefore, builders are confronted with the fundamental problem of how to:

- monetize their work without selling financial instruments to the public?

- release a platform without being at all involved in its deployment or operations?

- ensure a sustainable governance and operation of the platform in different stages of its genesis?

- entice a community of users to pick up the work?

Radical decentralization: Storytellers and Communities

Nietzsche says “Whoever reaches their ideal transcends it eo ipso”. We’ll get to why this matters in the context of launching DeFi protocols in the Metaverse later on. For now, just look at that Mustache.

Any solution that addresses the compliance challenges for builders should satisfy the following requirements:

- ensure full compliance of founders, managers, shareholders and affiliates at every stage of the process

- have a moderate to low price tag for achieving said compliance

- allow offering the full scope of DeFi interactions on protocol level, including token-based adoption incentives for growing TVL, user adoption and integrations as well as be able to give initial investors and angels an appropriate upside when the protocol becomes successful

Given where we are at as a society in terms of clarifying which laws and regulations do and do not apply to decentralized applications, any solution that purports to satisfy the above requirements needs to leverage decentralization as a strategy to flat out escape the regulatory frameworks of TradFi businesses — yet doing so in a fully compliant manner. Today, there is simply no way to offer the full scope of DeFi services to an unlimited, unkyc’ed audience while staying fully compliant as a centralized operator.

Therefore, any winning strategy needs to lead to a situation where the protocol in question:

- is fully decentralized and community owned even before launch

- while allowing builders to capitalize on the work done, and sharing the upside with initial investors

How could such an optimal solution materialize?

This is where NFTs, the Metaverse and storytelling come into play. Storytelling has always been a powerful force among human societies as far back as we can collectively remember. In the context of the stated problem, i.e. how to build an optimal path for builders, investors and users of DeFi protocols to come together and coordinate constructively, storytelling and the power of the metaverse could prove to be a powerful combination.

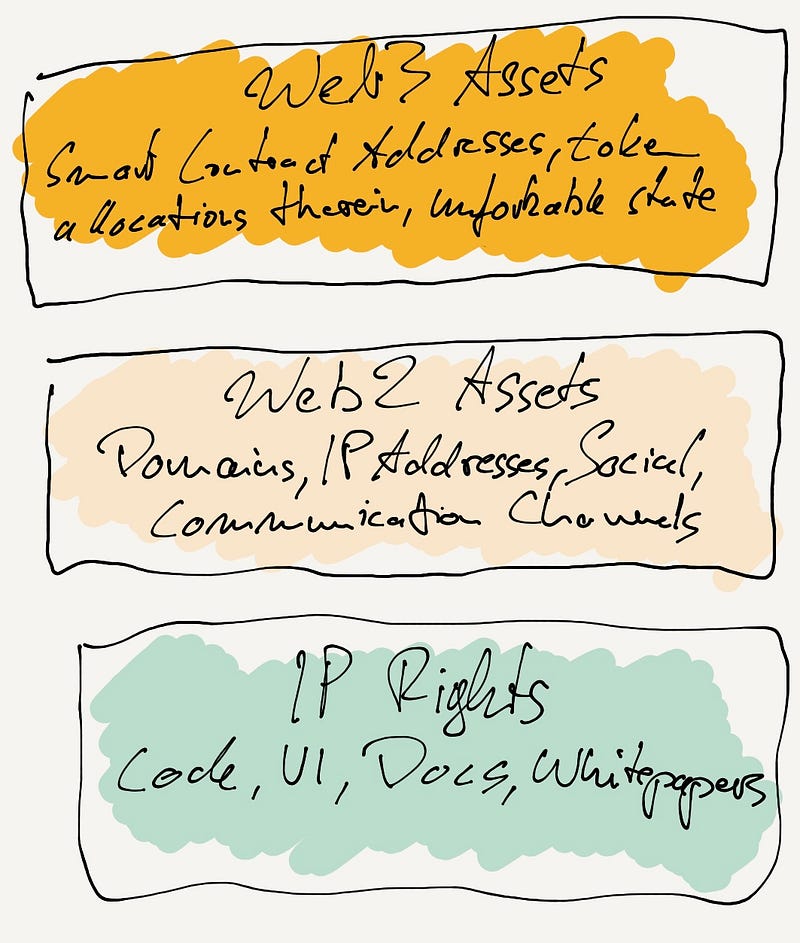

**Value Creation at different levels of the stack

**For crypto assets, value creation happens in different forms at different levels of the value stack.

The style of this image is heavily inspired by Ben Thompson’s stratechery.

Builders operate at layer zero, they write and design code and applications in raw files. Economically that value accrues as intellectual property rights on those raw bytes maintained through git and its ilk.

What the builders have developed is a set of copyright-protected software assets, in particular code, documentation and whitepapers, user interfaces and the likes. Most of those assets will eventually end up in the public domain under some permissive open source license, since the value created from those assets is ultimately embodied elsewhere, as crypto assets on a blockchain, the third layer in the value stack, fittingly called Web3 Assets.[2]

Insight 1: The public release or sale of IP — unlike that of crypto assets —carries virtually no compliance risks in terms of capital market regulation

Writing and releasing software, both commercially and not for profit are a core excerise of anyone’s freedom of expression and can thus be hardly regulated without resorting to censorship, with notable exceptions.

With that in mind, builders could simply sell their IP rights in a public auction to the highest bidder. By selling the IP, builders can capitalize on their work while spending effectively zero on compliance, globally. However, a direct IP sale is suboptimal in a number of ways:

- the auction is only interesting to small number of highly-specialized bidders

- no opportunities for retail investors and other non-specialized investors

- IP is being bought by a single party as opposed to a community

- the winner may harvest the IP in ways that neither the public nor the community will benefit from in the same way as they would have under a crypto native protocol launch that includes a token and adoption incentives for users etc.

Is there a solution where builders get the ease of selling IP that allows the public to participate in the future success of the platform in all the ways Web3 affords us and in addition to that allows the founding team to be involved in the Web3 Assets-related part of the value potential contained in the IP they created, all without overexposing themselves in terms of compliance?

Insight 2: Tokenizing the IP rights as NFTs before selling them solves those issues in a creative way

Auctioning the tokenized IP of a fully functional DeFi protocol to its future community of users could yield the desired endstate:

- deployment of protocol by community instead of builders

- lawful operations of protocol while being outside the regulatory framework of TradFi businesses by leveraging the power of true decentralization and being fully community-owned before protocol launch

- allows builders to capitalize on their work, sharing upside with initial investors

- opportunity for retail investors and other non-specialized investors to come in at a super early stage, i.e. before launch of a potential governance token or other IP exploitation efforts

- no additional compliance costs for builders beyond those that any software company has to deal with when selling IP globally (i.e. do a copyright audit and pick a suitable open source license)

- allows for the the full scope of DeFi interactions on protocol level without the limitations imposed on traditional financial service providers

Insight 3: NFTs are effectively equity in a future DAO, if the NFT buyers so desire. Or in other words: DAOSHARES

Say DAOSHARES three times in a row. Breathe. Again.

The idea that NFTs can serve as standardized containers for transacting rights, and in particular IP rights, is not particularly new. From the day of the first non-fungible token spec, in form of the ERC721 standard on the Ethereum blockchain, various ideas of how to do that were present.

Without reviewing the full scope of all possible approaches to tokenizing IP rights with the help of NFTs, a fundamental line can be drawn between two types of approaches, where one leverages copyright in a copyleft fashion and another in a traditional copyright fashion. In other words, an incluse and an exclusive approach to linking the IP with token ownership.

Currently the focus of the wider community seems to rest on defining contractual solutions that leverage a mix of exclusive and inclusive license terms vis-a-vis buyers and the general public in order to impose a suitable scheme of transferable ownership rights onto the IP and the NFT-related blockchain transactions. The method we present focusses on a different set of solutions that are less discussed so far but may have desirable features for a certain cross-section of decentralized projects.

Insight 4: Containerizing IP with NFTs can be done in various ways. We came up with a novel method that leans heavily on technological as opposed to contractual arrangements, while addressing all potential legal matters with a maximally permissive open source license for all IP being thusly transacted.

So how does it work in detail?

Tokenizing IP with NFTs, encryption and incentives

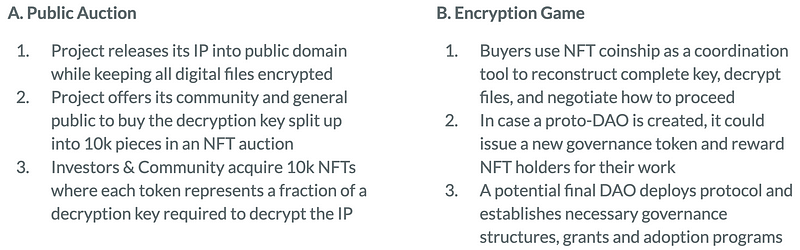

The method we present is split into two distinct phases, where in the first phase builders are handig over the project to their community and in phase two the community makes a choice on what they want to do with the project going forward, such as deploying a DAO or exploring totally different ways to exploit the IP.

Note that “releasing IP into public domain” is not possible in many jurisdictions. In that case it means to license the IP in a copyleft fashion such that it acts as if it were in the public domain.

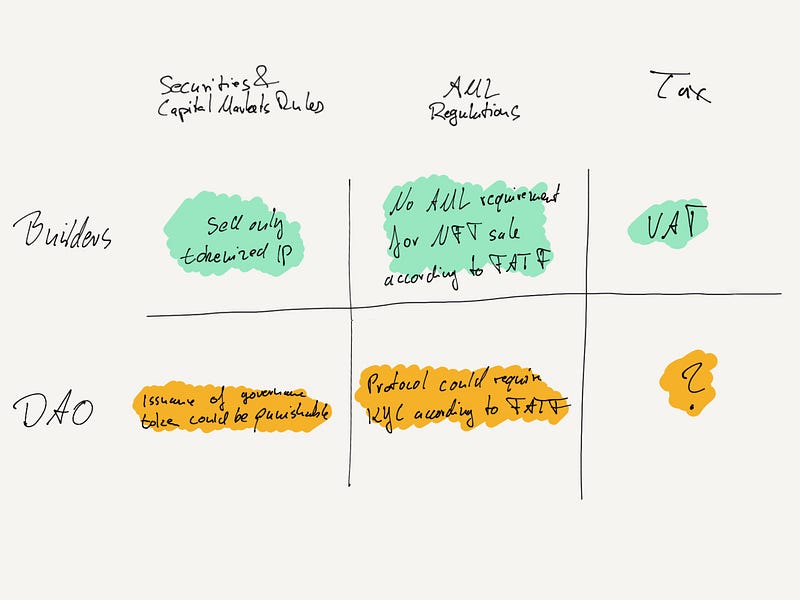

Compliance Considerations

The key compliance issues of the method we present can be captured in the following categories:

Protected Speech

The method we present complies with what FATF already said in its updated, yet non-binding guidelines, i.e. that non-fungible tokens don’t fall into the set of virtual currency schemes they intend to regulate with AML laws. The digital art aspect of NFTs does not classify NFTs as art from an AML perspective, such that the requirement for art dealers to KYC buyers of art pieces is not applicable, at least in Spain but most likely anywhere in Europe (since the definition of art is derived from the VAT directive which focuses on physical art)

Why this could even be legal for DAO members

Continuing the compliance evaluation, we eventually have to confront two important questions:

- Are builders liable for what happens with “their” IP after the NFTs are sold and the code has been released as open source to the public at large?

- Is the answer to question (1) affected by the particular outcome of the negotiations of NFT buyers with regards to how they plan to exploit the IP they acquired, in particular if that decision leads to the creation of a DAO and the deployment and maintence of an unregulated DeFi protocol offering services comparable to traditional, regulated financial services?

Before we go into the detailed answers to those questions, let’s make one thing clear up front: both questions are impossible to answer completely, since they are fundamentally open ended and pose room for scenarios where there may be actual liability of builders. However, if done right, there is a sustainable path of action for builders that yields the desired outcome while shielding them from liability for any action taken by NFT buyers after the sale.

Liability of builders for actions of a future DAO

Persons who developed software cannot be considered as a virtual currency service provider solely on the basis that those persons have created or sold the software in question. However, the FATF Guidance indicates that the activities of a software developer may also qualify as the provision of virtual currency services (and potentially regulated financial services) where

- the software developer retains control or sufficient influence over the assets, protocol or platform operation in whatever manner; or where

- the software developer is continuing the business relationship with their customers after the sale of the software.

Accordingly, it is important to determine for each DeFi Protocol whether there is a party in the system with control or sufficient influence to direct the operation of the assets, protocol or platform and who can therefore be considered to be a central party. Where such a party exists, it is likely that it would need to apply for an appropriate licence to provide a regulated financial service.

In the case of a software developer, such control or influence may, inter alia, but not limited to, arise where the software developer retains the rights to further manage the software or the software developer retains the rights to use the software and in addition to that:

- retains separate discretion to modify the operation of, or to grant access to, the protocol or platform;

- retains the right to vote on decisions concerning the system;

- has increased access to the data contained in the system.

- has the ability to influence the operation of the protocol through backdoors built into the software;

- earns a profit from transactions brokered through the protocol;

- provides consultancy services for the future operation of the software.

Indicators for continued control by builders are:

- who decides whether to correct or add enhancements in the event of bugs

- in cases where management and governance are organised through governance tokens, it should be clarified whether the builders have any influence on their distribution. If the originator retains some of the governance tokens for its own use, or determines their allocation among investors, this may be interpreted as an exercise of control or influence.

As a consequence, builders have to be unable to give any promises to the purchasers of NFTs containing the software decryption keys as to their future involvement in the management of the platform or the protocol.

Today, truly decentralised solutions are rare. Developers retaining control beyond what is in their best interest from a compliance standpoint is the norm, rather than the exception. In the method we propose, this does not have to be the case by default. It’s up to builders to decide the level of exposure they are comfortable with, including zero exposure if they so desire. The lower their exposure, the stronger their community should be, in order to compensate for the lack of future involvement at a decision-making level this decision comes with.

Liability of DAO members for actions of the DAO

Going further on this path for truth, let’s face the ultimate question whether DAOs are or should be considered liable for their actions in the scope of traditional financial market regulations.

One of the first things we had to learn on our path to arriving where we are today, is that when DeFi founders go from traditional venture-backed company to DAO, they most likely assume at least temporarily so such elevated levels of control in the context of a service that traditionally requires complex licensure, that from the perspective of most lawyers they likely overexpose themselves in terms of compliance and therefore face significant risk of legal repercussions both civil and criminal in nature.

However, the method we describe consciously avoids this path. Yet, there is still a DAO doing exactly the things that under the control of the original builders would likely violate securities and AML laws among other things. So what is different here?

After the public auction of the protocol’s IP as NFTs, there is a heterogenous group of actors (the buyers) who may have a diverse range of interests and ideas of how to develop the project further. In a very real sense, it’s a decentralized group of agents, who now need to come to conclusion of how to proceed forward in a way where everyone with a seat at the table can trust the promise that some of their demands will be fulfilled. Given that buyers are not bound to each other as employees or represenatives of any particular company, the path of least restistance going forward is to use a decentralized coordination and pay off mechanism to ensure to everyone that their purchase of IP will yield a beneficial outcome for them.

If out of this framework of incentives a DAO is born that ends up deploying and operating the DeFi protocol contained in the original IP acquired by NFT buyers, is that DAO by force liable under the same rules as traditional financial service providers? Or are there ways of governance and operation of the protocol by the DAO imaginable where we can truly speak of a decentralized service, operated by its users, as a public good and infrastructure, more than anything else?

The Metaverse brings the power of Frida Kahlo to everyone.

The more favorable interpretation for DAOs, i.e. that they assume a fundamentally new role outside of traditional regulation is being reasoned about and excellently argued for by Samantha Altschuler, Co-President of Harvard Law School Blockchain & FinTech Initiative in her recent article “Should Centralized Exchange Regulations Apply to Cryptocurrency Protocols?”.

But even more accute, the Europeans MiCA Regulation acknowledges the existence of services so decentralized that they may not be captured by the yet-to-be-finalized regime on crypto assets and service providers thereof. Could the method we present be a source of creation for such decentralize services that operate legally outside of traditional regulations?

Lastly, the famous DAO-analysis of the SEC in 2017 already stated that some Layer1 networks, such as Ethereum and Bitcoin, have reached a state of decentralization that puts them outside of traditional regulation. Given that increasingly securities transactions are settled on those public ledgers, the comfort of being considered extra-legal is an fundamental operating condition for public good-oriented services such as Layer1 networks.

Whether DAOs can find their place in this yet undefined, exotic extra-legal space is yet to be seen. And just as interestingly, the questions anticipated by Altschuler with regards to which rules will be introduced for this extra-legal space and how will they be enforced is are fascinating.

Concluding remarks

We have presented a new method to launch DeFi protocols that increases compliance of builders and gives operators of the protocol who want to work in a DAO setup a fighting chance to legally exit the realm of TradFi regulation.

Our method consists of releasing the protocol IP to the public at large, coupled to an NFT sale that — while unlocking the IP — allows buyers to bootstrap an on-chain community of users afterwards, in case they are interested.

The method we presented is based on the following insights:

- The public release or sale of IP — unlike that of crypto assets — carries no compliance risks for builders in terms of capital market regulation

- Tokenizing the IP rights as NFTs before selling them allows buyers to coordinate around what to do with the IP after the sale, independent of seller

- Containerizing IP with NFTs can be done in various ways. We came up with a novel method that leans heavily on technological as opposed to contractual arrangements, while addressing all potential legal matters with a maximally permissive open source license for all IP being thusly transacted.

Looking at the history of funding mechanisms for builders using blockchain and crypto assets this launch method is fundamentally different than the lineage of solutions that started under the monicker “App Coins” in the years 2014-2016, and which has since evolved to the current state of governance tokens. While both funding mechanisms employ crypto assets, our method uses those assets to document on-chain who contributed to the unlocking of the open source IP, leaving it up to the community of buyers to figure out how to exploit it.

Exported from Medium on January 3, 2025.